Dear Valued Customers,

As you may be aware the United States Infrastructure Investment and Jobs Act, which was signed into law in November 2021, reinstated and amended the Superfund Excise Tax, beginning on July 1, 2022.

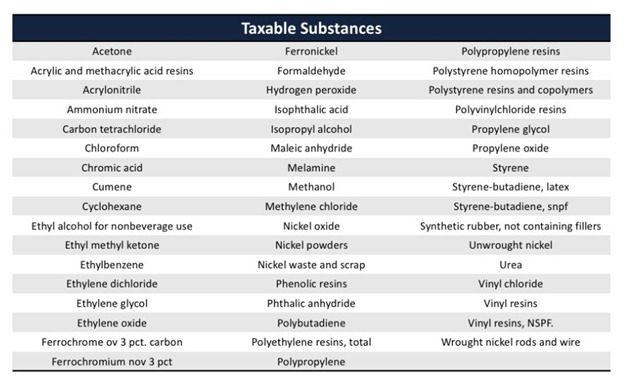

Internal Revenue Code Section 4661 will impose an excise tax on certain chemicals manufactured or produced in the United States, or imported into the United States for consumption, use or warehousing. Similarly, Internal Revenue Code Section 4672 will impose an excise tax on certain chemical substances imported into the United States for consumption, use or warehousing. The per-ton rate of tax varies depending on the taxable chemical being sold or imported, so the amount of Superfund Tax will vary by product. To put this in context, tax rates for taxable chemicals range from $0.44 to $9.74 per short ton. The table below outlines products that are impacted by this excise tax.

TRInternational continues to work with the National Association of Chemical Distributors (NACD) to better understand what these new taxes mean to our customers, and which products will be affected. In addition, the IRS is expected to issue additional guidance on or before July 1st. While we realize the financial and administrative burdens that these taxes place on all parties, we appreciate your understanding and support as we all work through this new tax implementation, and its effects. And as always, we appreciate your business.

If you have any questions, please reach out to your TRI team anytime, or call our main phone number at +1 (206) 505-3500.